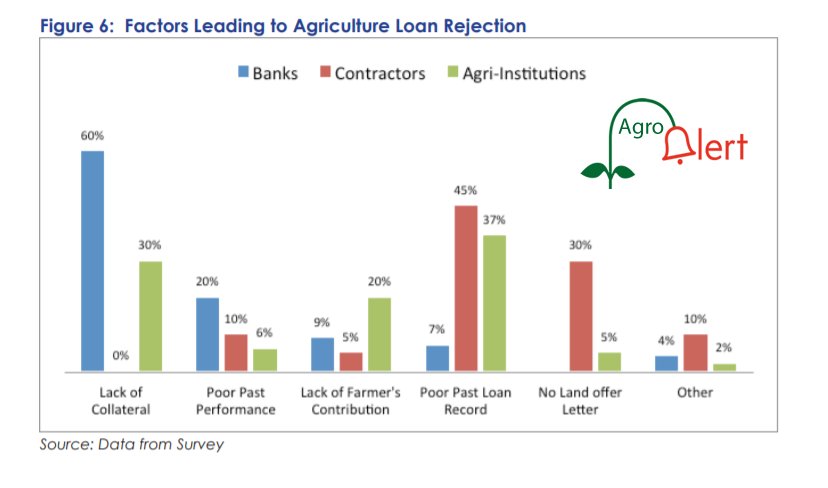

Top Reasons for loan rejection

Since the introduction of the multi-currency system in 2009, banks in Zimbabwe have

maintained between 10% and 25% of their loan portfolio in agriculture. With total financial

sector deposits of approximately US$2.5 billion in 2010, for example, this translates to more

than US$250 million being outstanding bank loans to farmers.

Surveys conducted on the country’s providers of finance to farmers, have indicated that conventional banks still

consider the agriculture sector a risky sector. Lower ratios of agriculture loans to total bank

loans, were, therefore observed in most big conventional banks. The smaller banks, which

are in most cases indigenous, tend to have higher loan exposures in the agriculture sector.

Factors that are considered by banks in appraising farmers’ loan applications include

availability of collateral security, past farmer production performance, farmer’s own

financial contribution and past loan performance.

On the issue of collateral, most banks require farmers or their guarantors to own physical

registered properties which can be used as security such as houses, land and business

premises and in limited cases transferable financial assets. The need for conventional

collateral security by banks explains most banks’ low agriculture loan portfolios. Among

the reasons for bank loan rejection by farmers, as shown in figure 6, for example, lack of

collateral security accounts for at least 60% of the rejected loan applications followed

by poor past farmer production performance, which accounts for 20% of the rejections.

Specialized agriculture institutions, including AGRIBANK are less restrictive on the use of

collateral security in farmer loan appraisals. Poor past loan performance, accounts for at

least 37% of loan rejection, while lack of collateral accounts for 30% by the institutions